The role of plant-based proteins

Food is one of the most promising market segments for EU plant proteins. In the context of agronomical, climate, environment and food security challenges, we believe that plant-based protein ingredients have a key role to play.

Several factors are driving this:

Socio-ecological factor

Pressure of animal-based proteins on the planet is enormous; this has become clear in the last couple of years in particular with more and more facts and figures. Hence, a lot of people decided to take action and make the shift, partially or fully, to consumption of plant-based protein types. This leads to less pressure on the environment and climate. Increasing preference for consumption of plant-based protein rather than animal-based protein may also be because of its beneficial role in weight management and reducing risks to chronic diseases (Marsh et al. 2013).

Ethical factor

Others may have taken this shift for ethical reasons such as animal welfare.

Health factor

Research is increasingly demonstrating that plant-based protein diets are healthier than animal-based protein diets (The Lancet, 2019).

Consumer Trends

Plant-based foods are making inroads with consumers, owing to the changing trends in terms of flexitarian, vegetarian, vegan or simply healthy eating habits. A recent survey by Mintel (2018) revealed that taste and perceived health benefits ranked highest among the reasons for US adults to eat plant-based proteins, which outranks concerns over diet, animal protection, and the environment.

Sustainability

Substituting meat with other protein sources has the potential to improve the sustainability of the food supply in Europe (EUFIC, 2017).

Typical applications

Meat products

Vegetable proteins can improve texture and mouth feel, reduce unsightly cooking losses and impact on nutrition/health. Judicious use of vegetable proteins can also offer a cost-effective way of extending the meat supply.

Dairy products

Vegetable proteins offer a cost-effective way of extending the milk supply or creating dairy alternatives.

Bakery products

As well as providing nutritional characteristics, vegetable proteins can be incorporated to provide texture, moisture management and bleaching effects.

Vegetarian Products

By definition vegetable proteins are the sole source of nutritive proteins in these products. They will also impart texture, emulsification and water binding properties if required.

Infant foods

Vegetable proteins are ideal protein sources for babies, especially those found to be intolerant/allergic to cows’ milk.

Miscellaneous

Functional and nutritional characteristics of vegetable proteins mean they often have a role in confectionery, beverages, sauces, snacks, soups, health foods, sea food… the list is endless!

.jpg)

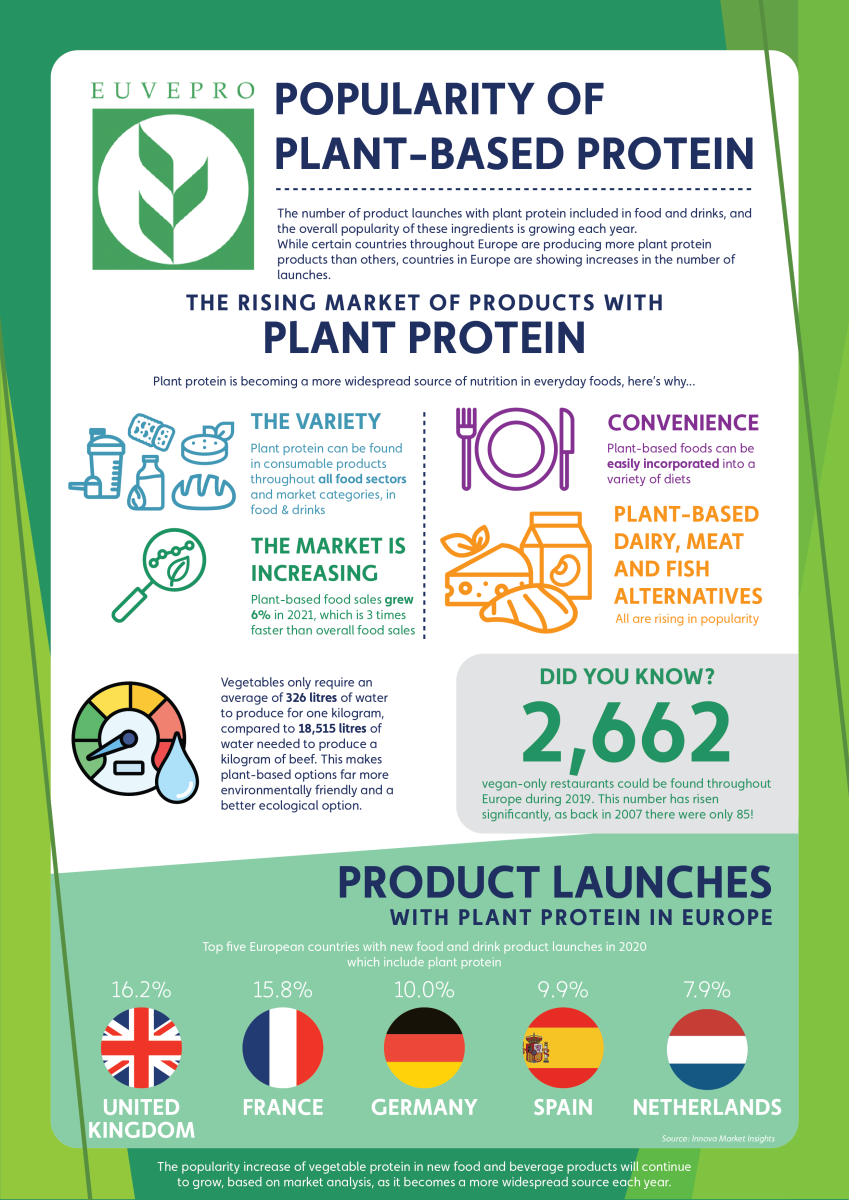

The market for plant-based proteins

In 2018, EUVEPRO commissioned a report into new food product launches containing plant-based proteins across the EU over the period 2007-2017. The report was developed by the market research company Innova Market Insights and was based on new product launches tracked in the Innova database.

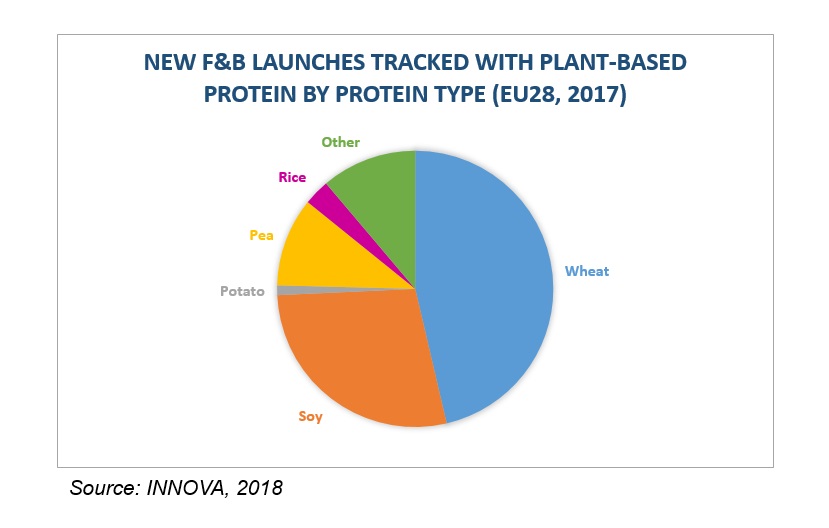

From an innovation perspective, the study commissioned by EUVEPRO in 2018 shows a huge increase in New Product Launches (NPLs) containing plant proteins in the period from 2007 to 2017. The average annual growth over this 10-year period is 13.5%. This innovative and dynamic market is growing and is increasingly attracting diversified sources of plant proteins such as rice protein and potato protein, in addition to the more traditional proteins: wheat, soy and pea.

The research report provides:

- An overview of plant-based protein use in new food and beverage product launches (NPLs) across the whole of the EU over a 10-year period.

- Details about NPLs by plant-based protein type, top countries and market categories, NPLs for each food and beverage market category and for each EU Member State covering the period 2007-2017

- Statistics on the fastest growing countries and market categories based on largest Compound Annual Growth Rate in NPLs (CAGRs).

Documents